United States, 1st Oct 2024, -

Examine bullish momentum for Bitcoin (BTC) through the network’s strength, price rise, and insights of experts for 2024.

CryptoNewsZ, a trusted source for cryptocurrency news and analysis, has released its latest report on Bitcoin’s (BTC) performance in 2024, highlighting the network’s continued strength and potential for significant price increases. As of the latest data, Bitcoin is trading at $57,961.01, reflecting a 2.44% rise within the last 24 hours, with projections indicating a possible surge to $80,000 within the next 30 days.

The report offers a comprehensive analysis of market trends, linking Bitcoin’s recent price jump to broader economic factors, including the aftermath of the U.S. presidential debate and anticipated Federal Reserve rate cuts. While market sentiments are currently bearish, long-term forecasts suggest bullish prospects for Bitcoin, with an expected increase of 40% from its current value.

Market sentiments are bearish for BTC but prospects are bullish for Bitcoin. It is projected to jump by 40% from current value to reach $80K, in the next 30 days.

Bitcoin Mining Difficulty Hits New Heights

Bitcoin Mining difficulty has made a comeback. Reports claim that the struggle at the moment is the peak for the operation. It is up by 3.6%. Factors that have affected Bitcoin Mining are revenues and rising costs. They are bound to have implications on the price of BTC.

Investors will be tasked with pulling the price up by injecting liquidity. This relies on the ease that the Federal Reserve delivers to the market with a cut of 25 bps. Also, the higher the difficulty, the more competitive the Bitcoin Mining market will get.

Miners will be required to mark upticks in computational power. This will see them incur more costs. With revenues on the lower side, fueling operations with increased costs may not be a suitable option at every corner of the Bitcoin mining sphere.

It roughly translates to the Bitcoin network becoming more robust and secure. It does bring something good for the network; however, the bigger picture is rather discouraging at the moment.

September's Bitcoin Blues: A Historical Pattern?

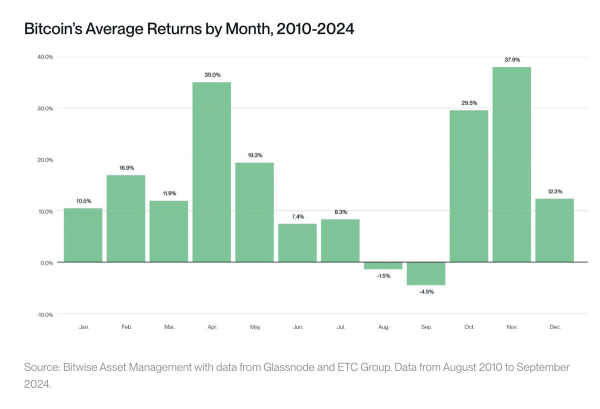

September is a month that is negatively associated with BTC. The month tends to bring losses more than gains. What follows is a phase of gains, though, thus making September more likely a period of correction ahead of significant surges. This is based on historical trends that have introduced the September Effect throughout the course.

Its price, reportedly, has dropped by 8% which is below the average decline of 5%. Interestingly, June is another month that witnesses losses. The average price for the month comes to -0.35% loss movement.

Nevertheless, a Golden Cross is being formed on the price chart. It brings the chances of bullish implications in the future. In other words, ongoing bearish sentiments will eventually turn bullish as the BTC price moves forward. Near-term Bitcoin price predictions support this thesis. An early effect could happen in the next five days if the value breaches the mark of $68,000.

Short-Term vs. Long-Term Bitcoin Investors

The behavior of investors helps determine the price of BTC, or any other cryptocurrency for that matter. They are ideally divided into short-term and long-term investors. The former aims to take profits home within 6 months.

Exceptions are drawn only if the BTC takes longer to rebound. Otherwise, most of the returns are fetched within the said timeline and investors begin withdrawing their funds. If in large numbers, it creates a selling pressure to push BTC’s price down.

Long-term investors tend to hold onto their portfolios to make larger gains. Alternatively, their aim could be to support the ecosystem along with all the innovative launches that are scheduled.

Long-term investors continue accumulating coins to make the best of ongoing dips. This is the time when short-term investors are shedding weight and the same is being bagged by long-term investors.

Analysts’ Outlook on Bitcoin's Future

Analysts have outlined their pieces of opinion for BTC. Two notable analysts sharing a contrasting outlook are Michaël van de Poppe and Bitwise CIO Matt Hougan.

Michaël van de Poppe believes that a crash is on the horizon before the Federal Reserve cuts rates. It could take the value to $45,000 with other factors contributing to it like liquidity injections and weakening US economy.

He published his post on September 08, 2024, when the price of Bitcoin was around $54,000 at a correction of approximately 26% since the recent ATH. Calling it a regular correction, Michaël van de Poppe stated that similar points appeared in November 2022 when FTX collapsed.

Hougan is largely focusing on the upcoming bull run which will tentatively happen in October-November this year. His analysis also examines historical trends plus ongoing conditions. Hougan thinks that Bitcoin is poised for a rally despite opposition that may come in any form or kind.

Factors Fueling Bitcoin's Bullish Momentum

On-chain data suggests a positive outlook for Bitcoin. Small holders are aggressively accumulating, driven by rising confidence. Global political events and the Federal Reserve's rate cuts can influence prices.

Geopolitical tensions and market volatility can create uncertainty but also offer opportunities. Bitcoin's price is subject to natural fluctuations, but the overall trend is bullish.

There is a correlation between how much smaller wallets hold and the potential for price rise. The higher the holding the higher the prices aim to go. That essentially forms a part of accumulation that long-term investors deploy as a strategy during the dips. Major predictions project that Bitcoin will hit $90,582 by the end of this year. Alternatively, it could settle for $81,125.

Conclusion

The network strength of Bitcoin will be judged by how well miners navigate their way around the prevailing complexities of competition and costs. Historical trends are siding with the prediction that September will be on the lower side before marking upticks in October. Overall, expect BTC to aim for an ATH and meet expectations by the end of 2024.

Organization: CryptoNewsZ

Contact person: John Chamberlain

Website: https://cryptonewsz.com

Email: contact@cryptonewsz.com

Address: California, Los Angeles,USA

Country: United States

Release id: 10347

Disclaimer: The views, recommendations, and opinions expressed in this content belong solely to the third-party experts. This site was not involved in the writing and production of this article.